An annual insurance review is a great opportunity to consider all major life events that occurred in the previous year. Whether it’s getting married, having a child or making a major home improvement, you will want to make certain that your coverage reflects changes in your life and provides you with adequate coverage.

During the annual insurance review, you will need to look at your home, auto, life, and umbrella insurances to ensure that your policies match your current coverage needs and budget. It is all part of managing your personal life changes.

A lot can happen in one year that can have a significant impact on your insurance costs, coverage options, and limitations. Among these are the following:

- Marrying or divorcing

- Children graduating from high school/empty nest/child off to college

- Beginning a new job

- Recruitment of new employees

- Purchase new commercial equipment

- Establishing a new enterprise

- Accepting elderly parents into your home

- The acquisition or receipt of an ostentatious gift

- Your immediate family member has died

- Mortgage repayment

You should notify the insurer if you buy or sell a home, a vacation property, an automobile, or a recreational vehicle. You should also notify them if you have remolded your house or moved to another location.

Each of these things can trigger substantial changes in your coverage needs and your annual premiums. If it’s a major event that has changed your life, chances are it will alter your insurance coverage needs as well.

An annual insurance review of your policies gives you the opportunity to explore how these changes affect your coverage needs and ensure that you have appropriate coverage.

Here are few questions you may want to ask your insurance broker at your next review.

Do I qualify for any available discounts? Many insurance providers offer a variety of discounts. Something as simple as choosing a newer vehicle with advanced safety features can help you save on your insurance premiums. Updating the wiring in your home or adding a new alarm system may result in discounts on your home insurance. Additional discounts may apply if you insure both your car and home through the same provider, if you don’t have any claims, or if no one in your household is a smoker.

Does my policy provide enough coverage to rebuild my home today?”

Insurance companies replace lost items with “like kind and quality,” it is important to estimate the full cost of replacing finishes, appliances, electrical systems and plumbing systems in determining your coverage.

Many homeowners are surprised to learn that their policy is outdated and does not provide sufficient coverage to rebuild their existing home. Changes in construction costs (they can vary from year to year), upgrades to a kitchen or bathroom, new kitchen appliances, or updates to a basement can all affect the cost to repair or rebuild your home. For example, new finishes in your kitchen can change your existing kitchen from “standard” to one that’s considered “semi-custom” or “custom.”

I just got divorced, can that affect my auto insurance?

When you separate from your partner, you can no longer claim the multi-policy discount that you received during your marriage. Insurance rates will most likely rise when you lose a spouse to either divorce or death.

If divorcing, make sure that you get your partner’s consent before removing them from your coverage. Get different addresses for yourself and your ex and use them for each auto insurance policy. You will share liability if you still live at the same address.

Will a newly finished basement affect my policy?

A finished basement may not only increase the cost to rebuild your home, but it may also require additional coverage to protect items from water damage. For example, optional water backup coverage will help protect new furniture and carpet in your basement if a sump pump breaks or a drain backs up.

Does my policy cover landscaping or outdoor appliances?

Installing a new sprinkler system, a larger storage shed, a new pool or hot tub, or buying a substantial backyard grill are outdoor changes that may require a homeowner’s policy upgrade.

Do I need extended coverage for valuables?”

Your existing policy provides standard coverage for your home and belongings, but this coverage may not be sufficient for all your valuables and is frequently overlooked. For instance, you may need additional coverage for wedding rings, valuable golf clubs or other sports equipment, family heirlooms and antiques, musical instruments or artwork in your home.

Conclusion

Life situations change from year to year and it is important to manage how those changes will affect our finances and insurance needs. Plan to meet yearly with your insurance broker to go over an annual insurance review of your personal life situation and make adjustments to your policies accordingly.

Annual attention to your insurance coverage could save you thousands of dollars in the long run. When was the last time you reviewed or updated your insurance policies?

The Annual Life Insurance Policy Review Checklist: 7 Easy Steps

A thorough life insurance policy review should start with this checklist. By checking off each box, you’ll be able to assess whether or not you have enough, or the right, coverage—or whether you need to turn to a trusted financial advisor to fill any gaps or update information.

- Step #1: Assess your current policies to determine if you have sufficient insurance coverage.

- Step #2: Review your policies to ensure that coverage has not lapsed and will last as expected.

- Step #3: Update policy beneficiaries if necessary and check that policy ownership is optimal.

- Step #4: Research the financial health of your current insurer.

- Step #5: Evaluate the previous year’s life insurance goals and whether they need to be adjusted.

- Step #6: Protect your estate from taxes by researching potential federal and state tax implications.

- Step #7: Request recommendations for updating your policies from a trusted financial advisor.

Step #1: Assess the Current Coverage of Your Life Insurance Policies

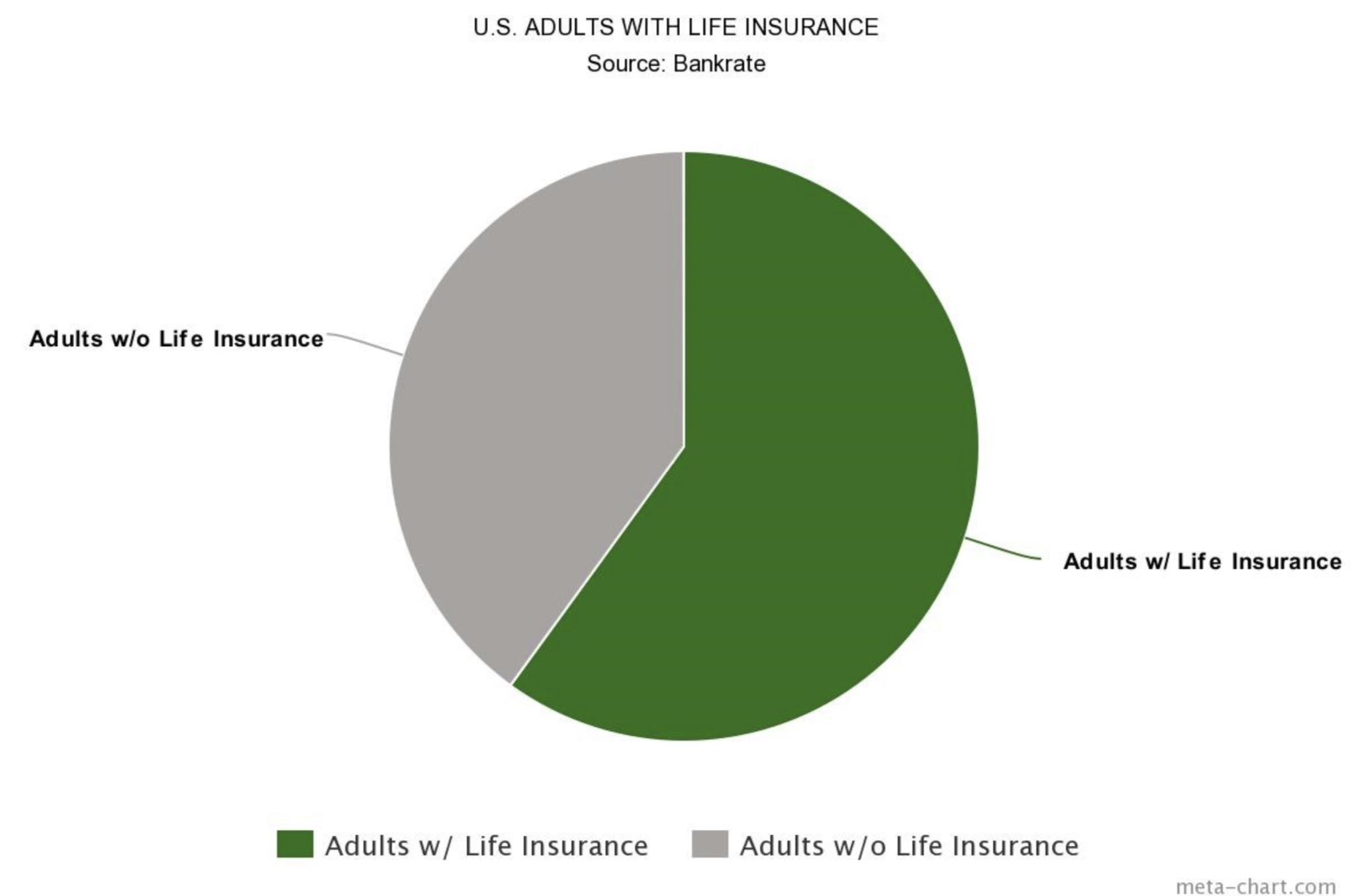

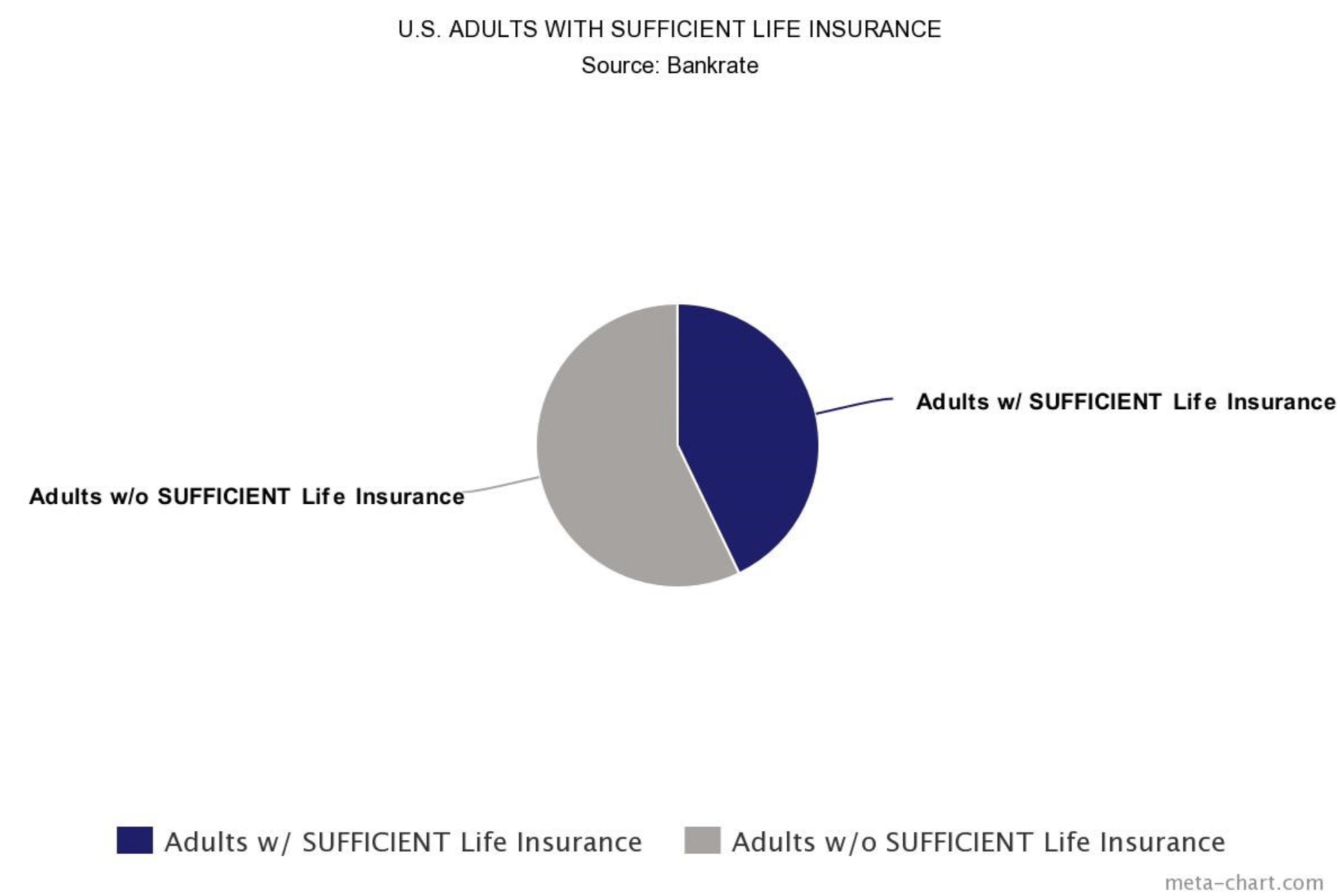

According to research from Bankrate, 60% of Americans have life insurance, but only about half of them have sufficient coverage to protect the actual financial needs of their family. A key goal of any life insurance policy review, therefore, is to determine if your coverage is realistically sufficient should a major life event occur.

Life insurance is typically purchased during key life stages, i.e. when you get married or have your first child, and then put on autopilot, as you pay your premiums without much thought. However, as you age or your family grows and spreads its wings, you need to reassess your coverage.

If you have several teens, are you financially prepared for college? Or, alternatively, do married adult children need less protection than when they were children? Also easy to overlook is the rising cost of funeral expenses—something that may not have even been a consideration when you first purchased your policy in your younger years.

Step #2: Review Your Life Insurance Coverage

Life insurance policies that were purchased over 10 years ago may either be out of date or have lapsed—and you may not even be aware of it. For instance, recent retirees often see their generous work-sponsored policy lapse after they step away from their careers.

Workplace life insurance is a common form of coverage but is designed to cover families in the event of the unexpected death of the breadwinner. These policies often end upon separation from a company, including at retirement—a time when excitement for your new life stage can often overshadow insurance policy logistics.

In addition, many universal life policies have seen adjustments to their mortality and expense charges which have had a negative impact on the coverage duration. A policy that was scheduled to last through age 90 may suddenly be on track to lapse at age 83. If that is sooner than your life expectancy, you have a problem that needs to be addressed immediately. A life insurance audit can identify outdated policies so that you can fill any coverage gaps with the help of a financial advisor.

Step #3: Ensure All Your Desired Beneficiaries Are Protected and Ownership Is Correct

Keeping your beneficiaries, as well as your policies, up-to-date is another critical step in your life policy annual insurance review. Schedules are busy and free time hard to come by, especially after major life events. You may not have made changes to a policy after a divorce or the death of a loved one. Perhaps new grandchildren need to be added as beneficiaries or adult children’s shares reduced.

A life insurance policy review and audit presents an opportunity to confirm the contingent beneficiaries on each of your policies, as well as who will receive the policy proceeds in the event that your primary beneficiary has passed away. The more possibilities that are accounted for when it comes to beneficiaries, the better for the health—and stability—of your family and their financial future.

Ownership is critical as well since improper ownership can lead to very harsh tax treatment. It may be beneficial for policies to be trust-owned or owned by children or someone else depending on circumstances. This is very important and should not be overlooked.

Step #4: Research Your Insurer and Their Services

This step of the life insurance policy review is where it becomes absolutely critical to have the guidance of a professional. The financial health of your insurance company or companies must be assessed on a yearly basis; instability in the financial markets may have had an impact on the company underwriting your policy. A goal of your audit should be to ensure that your provider is still in a good long-term financial position to meet its obligations, including the eventual payout on your policy.

An experienced advisor will have the expertise to review your policies. They can also research your specific life insurance products and if your premiums are in line with your coverage. Insurance costs fluctuate year to year. Your advisor should not only be helping you work toward your long-term goals, but also optimizing your current premiums, potentially saving you money in the short term as well.

Step #5: Evaluate and Review Your Life Insurance Policy Goals

As you review your life insurance policy coverage, you should evaluate the goals of your current policies. For example, you may have purchased a policy to safeguard your spouse and children, ensuring that the mortgage would be paid and college expenses covered in the event of your untimely death. If your children have graduated and the house has been paid off, however, a policy expert may advise you to reevaluate your goals and make adjustments as necessary. Perhaps your focus can be realigned from covering college expenses to helping your children build up a retirement nest egg, for instance.

Health considerations also fall into this phase of the audit and are a key factor in why experts recommend annual life insurance policy reviews. Your ability to procure a new policy may be tied to your health and expected longevity; an annual assessment will enable you to make coverage adjustments if there has been an unexpected change in either. Make sure to talk about these important factors at your annual insurance review.

Step #6: Protect Your Estate from Taxes

Your financial advisor should have provided guidance on minimizing estate taxes when you initially purchased your policy. However, if your coverage includes employer-sponsored insurance or additional policies you may have purchased separately, they—and you—may not be fully aware of all of the estate tax implications and potential pitfalls. An expert financial advisor will conduct a full review of tax liabilities as part of your life insurance policy audit.

Step #7: Recommendations for Future Life Insurance Policies

After your life insurance policy review checklist has been completed, you should have a clear picture of your current coverage, as well as any potential gaps or oversights. If it turns out that you and your heirs are properly covered, your time investment is still well worth the ROI in terms of greater peace of mind. If, however, there are any gaps in your coverage, your advisor will be in a prime position to recommend the best financial solutions specific to you and your family’s circumstances, which could include additional policies, pre-emptive tax planning, or the inclusion of other financial planning products and services that will help you achieve your goals for a financially secure future.

Just as fire departments advise that homeowners use Daylight Savings as a reminder to check the batteries in their smoke detectors once a year, you should consider penciling in a life insurance audit to your yearly calendar as well. The day you choose is of no consequence, so long as you schedule a time, every year, to sit down across from your financial advisor and thoroughly review your existing life insurance policies.

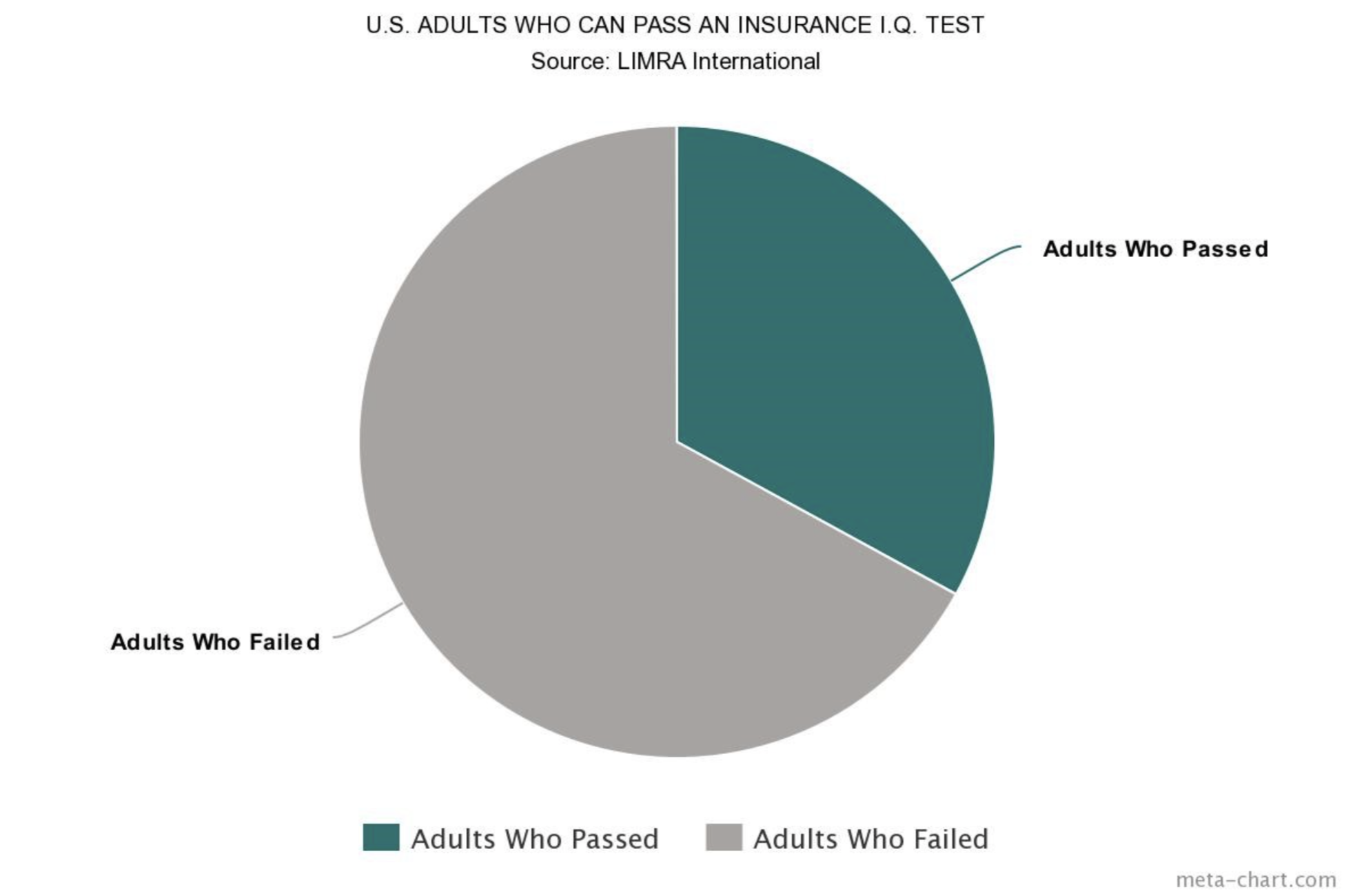

Several years ago, the Life Insurance Market Research Association (LIMRA) conducted a life insurance IQ test; only one-third of consumers passed. Most Americans don’t have a good understanding of life insurance, let alone their specific policies. Take the exam for yourself, then decide if you want to risk the financial health of your heirs when an afternoon sit-down with an advisor could provide all the security you need for the coming year. The risk of insufficient coverage or erroneous policies is significant and could be devastating. Call your advisor today for a life insurance policy audit and review. Don’t leave your financial future to chance.